Simple Bank

Savings Concept

Role: Strategy

Art Direction: Jason Strand

UX: Jos Vaught

Motion Design & Prototyping: Louise MacFadyen

Project Overview

Saving money is hard, this much we know. How to get more people — especially young people — to move past personal and social barriers and begin saving was the question Simple brought to this project. Tasked with researching cognitive biases that prevent saving, and utilizing established behavioral economic principles that might entice it, we were asked to create a series of concept apps designed to help Simple better understand what Simple's first savings-orient product might look like.

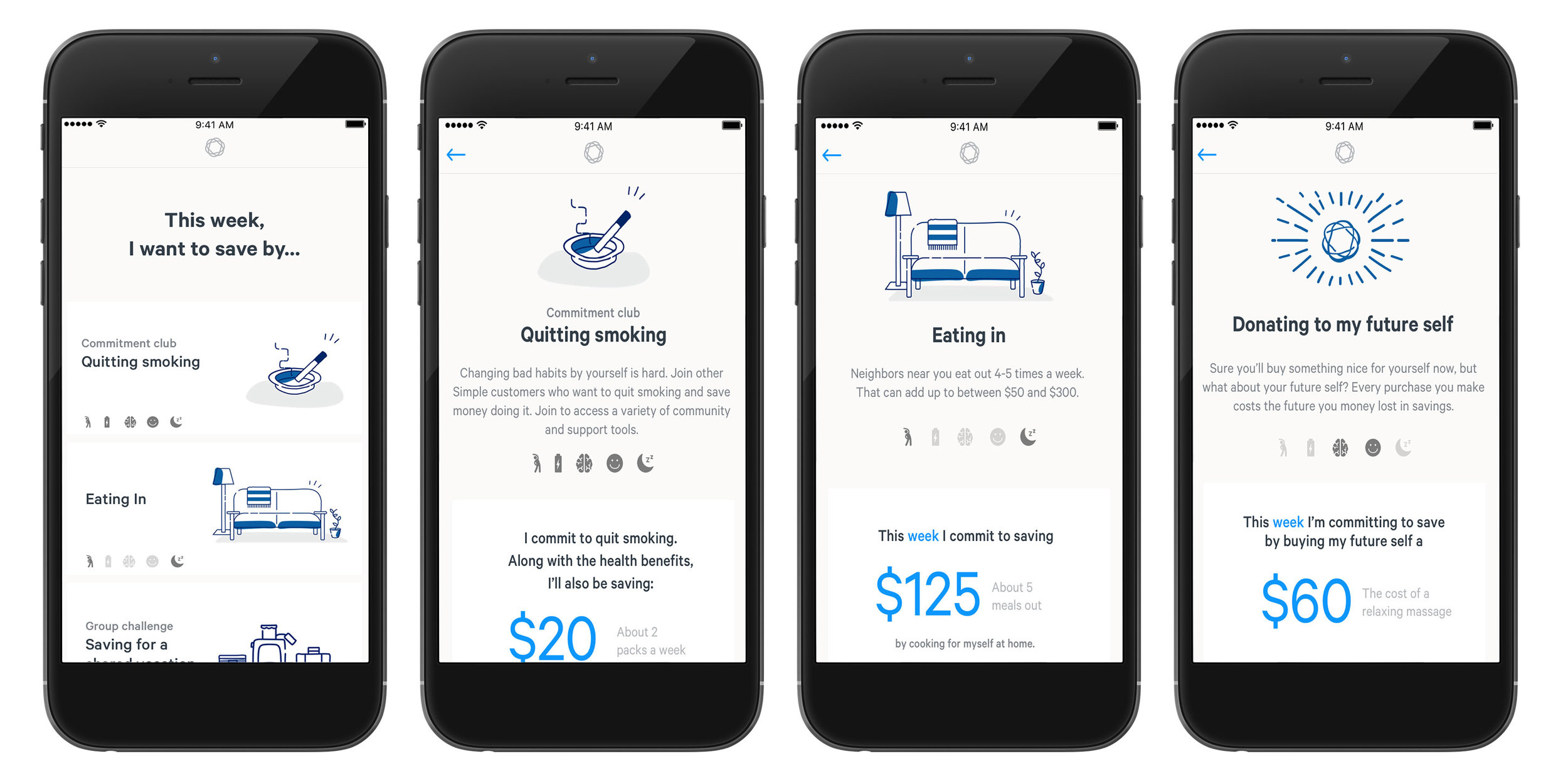

Concept 1: Challenge

In this concept we examined a system that provided motivations by connecting the benefits of saving to more direct, immediate, and personal goals. By diversifying the types of challenges provided we were able to add a layer of meta-research to the project and look at what types of challenges — health-related, social, environmental, etc. — provided the greatest response.

Concept 2: Savings Trainer

This concept borrows many of the systems used to help people achieve another popular, but challenging goal: personal fitness. In the same way a marathon training program breaks down one large goal into many, much smaller tasks, we took larger savings goals and broken them down into small daily tasks. By self-identifying as a beginner (someone with no savings), an intermediate, or an already advanced saver, the system would provide a multi-week program letting a user know what to do each day to meet their goal in their desired time frame.

Concept 3: Savings Agent

In this concept we leveraged the fact that most successful savings programs are the ones people think about the least: 401k and IRAs. Using this principle of "set it and forget" we imagined a model where a saver could set up a series of "triggers" that would automatically pull money from their checking account and move it to their savings. Those triggers could be anything from pulling a bit of every paycheck, to balancing spending on luxury items like coffee or movies by automatically putting an equal amount away each time an item is purchased.